Webinar Overview: GeoInsurance Ireland 2022

NEW RISKS AND MEASURES FOR PROPERTY IN A CHANGING CLIMATE

KEY TAKE-AWAYS:

- Use cases for different data types in helping to determine residential rebuild costs and pricing risk

- An approach to understanding the forward-looking impact of acute and chronic hazards on assets/properties

- Taking a step towards measuring climate related impacts on existing books of business – in terms of physical (value exposure) and transitional (emissions) risk.

Setting the scene

Our knowledge of climate change is evolving all the time.

And along the way it is bringing new requirements for property-level data and models to enable insurers of all sizes to better assess changing peril risks and climate impacts.

So, what can insurers do in Ireland to address this challenge?

Trusted solutions for now & tomorrow

Richard Garry of Gamma Location Intelligence hosted the session and opened by providing an overview of the business and reassurance that it is ideally placed to consume and enable clients to use climate change data and insights to make better informed decisions.

In practice, Gamma provides solutions to insurers and banking sectors that include geocoding, and peril data (including flood, subsidence, crime, and fire), as well as projecting those datasets forward to consider climate change. As a companion product, Gamma also provides additional property-level attribute information within AddressLink.

Fundamentally, the accurate positioning of where a property or location at risk is and then overlaying any adding information related to that location – be it peril or attribute data.

THE USE CASE FOR DATA IN THE NOW

Over the last few years, the GeoInsurance webinar series have aimed to keep the insurance and other sectors up to date on what’s happening – with a special focus on data, peril data, climate change and ESG.

That theme continued with a review of data that can help… now.

Charlotte Cuffe – lead data scientist at Gamma – focused her session on the use case of data types in helping to determine residential rebuild costs and pricing risk.

In particular, the importance of context in the provision – and use – of data output products.

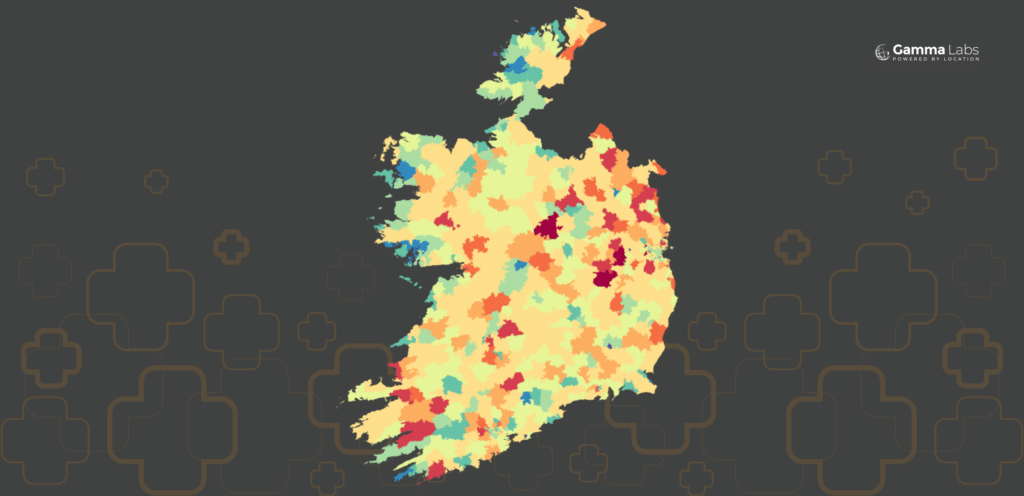

In simplistic terms, the data modelling pipeline is a 3-phase process:

- Data inputs are gathered,

- They are then used to train a model, and

- Then that model produces outputs.

However, one key ingredient missing from that process is domain knowledge.

Slide Image 1: The data modelling pipeline

As such it is vital to gain understanding of:

- What that data is,

- What are the cause and effects impacting the numbers that you are analysing, and

- Clarifying what has been captured to guide your judgements around which input variables you should:

- Use for modelling,

- How you might want to transform them and

- What types of models to fit to get the best predictions.

This is well understood.

However, it is the output – or the problem to be solved – that also needs consideration.

Understanding the output… to be or not 2B, that is the obvious question..!

The output can be viewed differently depending on the model used to create it.

It should always be remembered that a model doesn’t exist in a vacuum – it exists to resolve a specific business problem, which in turn is reflective of the output produced.

To illustrate this point, several use cases were reviewed.

Use case 1: Number of storeys in the property

For Form Pre-fill – as a means of enabling a customer’s ease in completing a request for home insurance and providing them a good user experience – the requirement of the data would be to provide a pre-fill for the number of storeys as a whole number. So those with a 1-storey building would see 1 and those with a 2-storey building would see 2, and so on.

However, another user of the data may be interested in using storey data as a means of determining re-build cost.

For edge cases – where the number of storeys may not conform to the norm – the user may need a fuller understanding of how many storeys exist, alongside the overall footprint of the property, as this would lead to increased accuracy in how much the rebuild of a property will be.

As such, the use case determines which approach is better suited to the situation – or business problem – that the user is looking to resolve.

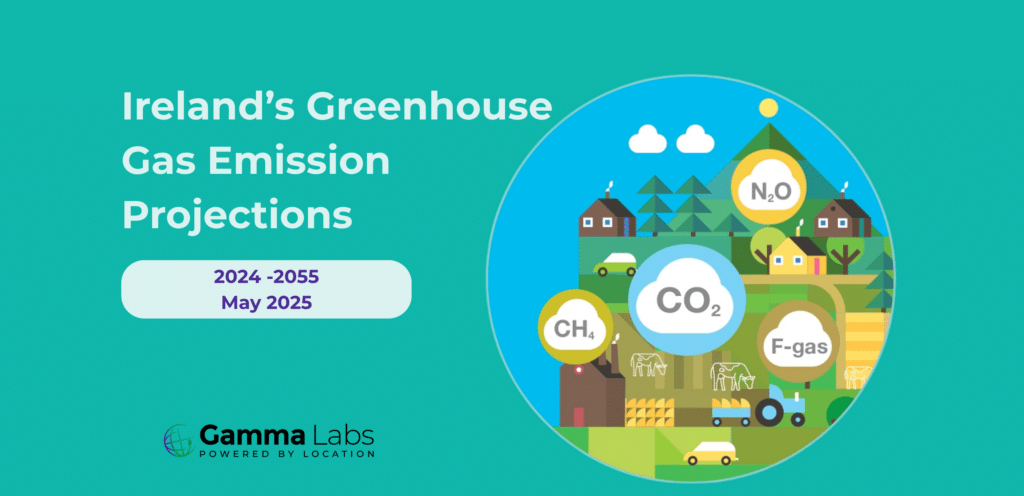

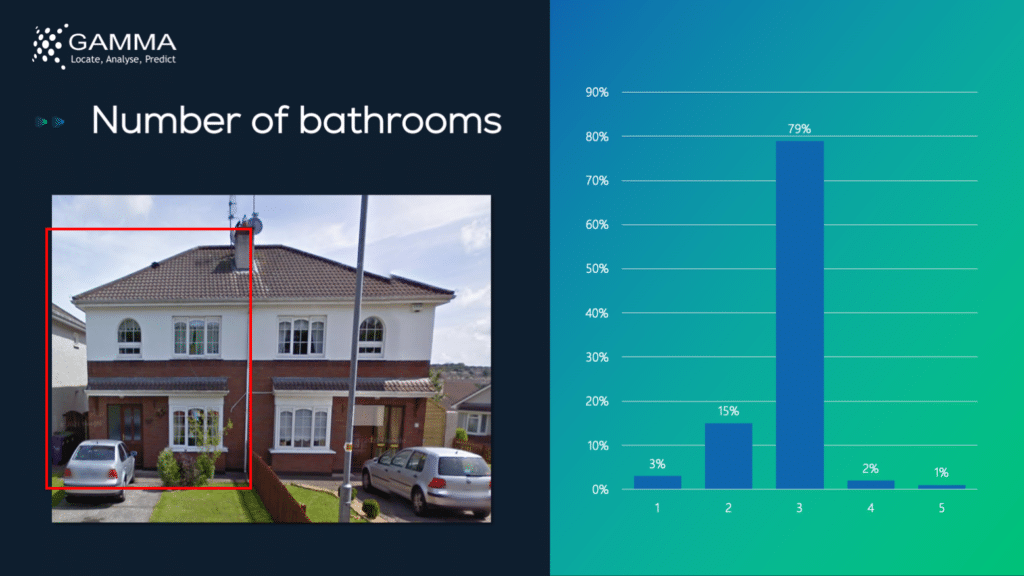

Use case 2: Number of bathrooms in a property

As we all know, the number of bathrooms in a property can be an influencing factor in the value of a property.

Conversely, the number of bathrooms also presents additional risk from an internal water damage perspective:

more taps + more pipes = more chance of water damage.

And a higher chance (probability) of the owner making a claim for water damage.

Slide Image 2: Number of bathrooms – a spread of probabilities

Appraising a “typical 3 bathroom” property from a Form Pre-fill perspective, there is a level of confidence in stating that the property has 3 bathrooms – again saving the potential customer time in their sign-up journey. We’d be 80% confident that this would be the case. Using any other value would be unlikely – and less helpful in streamlining their onboarding.

However, aiming to understand how may homes in a portfolio of properties that may be looking to refit or update their bathrooms, then it would be advisable to apply the full range of probabilities from a bathroom perspective.

Again, the context with regards to what the business issue is that needs resolving, determines the level and type of data that can be useful in solving the query.

Use case 3: Building energy rating (BER) data

Over recent years the BER (or EPC in the UK) score for a home has been seen as a means of differentiating property value in similar types of homes.

Conversely, those organisations that offer specific solutions to low rated property owners may need to determine where they prioritise their outreach in order that those in most need are communicated with and made aware of what solutions may be available to them to improve the energy efficiency – and ultimately the desirability of their property.

However, the rating alone is not the only data point that might be of value when looking to address specific business issues and understandings.

Existing and potential efficiency. Energy usage. Emissions and fuel use.

All these different variables allow for a multitude of insights to be sought and a multiplicity of business issues to be answered.

What about the future..?

Existing model development and updates to data points within AddressLink will continue in to 2023 and beyond.

Updates to perils, models, property attribute enhancement and rollout to other territories.

Our journey has only just begun. But it will continue to evolve as needs develop.

Underinsurance is a big issue at present – so good to see a solution for that. However, with regards to BER scores/data for Ireland, there is some confusion as to the accessibility of that data. Is it possible to access BER data for a building directly from the SEAI?

SEAI do allow access to building certification and energy records. However, they redacted the address, so a model is needed to allocate attributes for wider use – or for more than one property at a time. An individual can access their own ratings data, but unless you own that property you can’t access the data/rating, alongside the address.

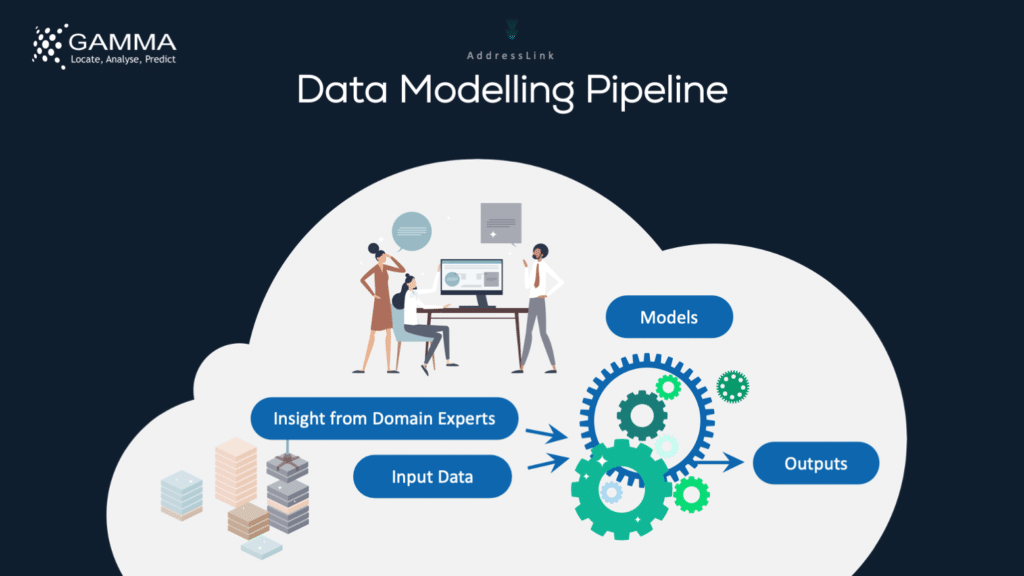

CLIMATE ANALYTICS FOR PROPERTY IN A CHANGING CLIMATE

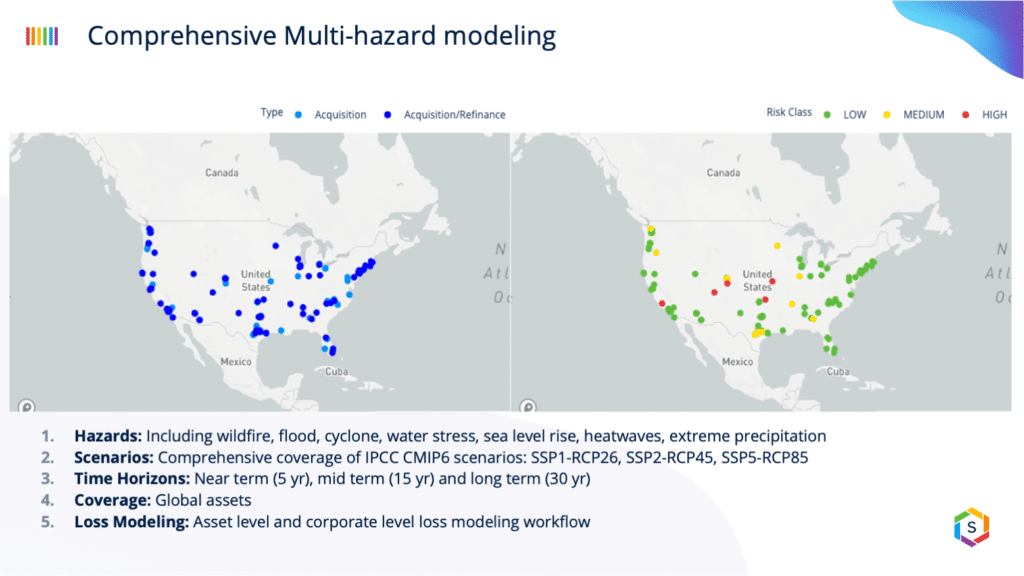

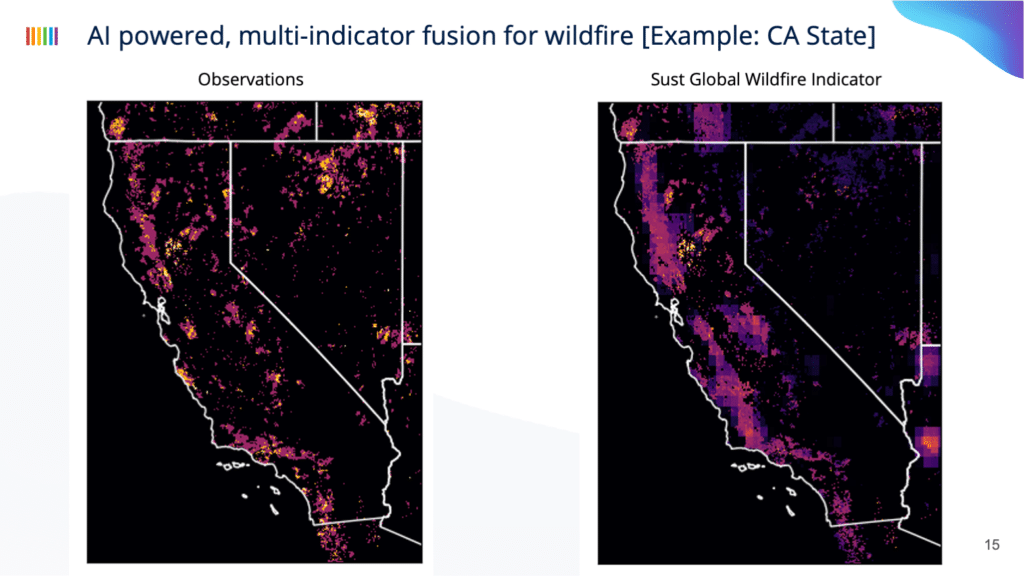

Taking a view of the medium-term, Gopal Erinjippurath, CTO and Head of Product at Sust Global, provided an overview to modelling emerging risks such as wildfires, using AI and remote sensing.

More frequent and sever climate events are costing the global economy.

Sust Global’s mandate is to turn complex climate science into validated data and APIs that can be implemented into workflows of financial institutions and insurance organisations.

As an approach, Sust Global:

- Collates a variety of open source, post-validated climate models and data sets,

- Combines these with analytics and deep learning and AI techniques, and then

- Align these with commercial data streams to enable easy querying at the asset level to understand property level risk exposure and impact.

As is widely accepted, understanding risk exposure, and coupling that with building level attribute data (or asset level information) enables richer estimates to be produced as society plans for the future.

Bringing comprehensive, multi-hazard* modelling to serve up comprehensive insights.

Climate modelling and data

Looking specifically at wildfire as a hazard/peril, there are various projections that exist. From the general circulation model (GCM) which is coarse in terms of resolution, through regional climate models (RCM) giving moderate resolution, through to high resolution observations of burnt areas at a local level.

Sust Global’s approach effectively layers these models and observations to derive an exposure score.

Slide Image 3: Comprehensive multi-hazard modeling

The objective of Sust Global’s approach is to bring the resolution and bias correction of observational data derived from remote sensing and satellite imagery sources into what a climate model projects.

The result being a smoothing of the insight predicted in low resolution global climate models, to high-resolution forward-looking projections across various scenarios. Thus, enabling businesses to assess asset level and operational impacts.

The integration of observational data alongside forward-looking projections enables the user to view the impacts based on the most recent dynamics (and patterns), rather than based on projections alone.

Slide Image 4: Example wildfire model using IPCMIP6 models & observations

The ability to deliver a model that has a higher level of performance in predicting future exposure – and for dynamic and growing perils – is quite exciting.

(Better still) Enabling that through Perilfinder will better equip decision making around both current and future exposure at the asset (or property) level – which is key for businesses to understand when taking on risk.

Impact modelling

Alongside the predictive modelled data solutions, Sust Global also takes a view on the impact of risk translates to financial values.

By appraising hazard distribution alongside a generic hazard damage function, it is feasible to determine an impact distribution that can be applied to a portfolio of property assets in terms of the forward risk impact from an insured or investment perspective.

This approach can help address questions such as:

- Where is the concentration of vulnerability,

- What is the extent of risk exposure, and

- What is the extent of predicted impact , at the portfolio level..?

Typically, these appraisals would be visualised in terms of heat mapping – allowing appraisers, advisors, investors, and insurers to gain a better handle on the future impact that changing hazards might inflict.

In relation to the modelling of data gaps, how do you achieve this using AI?

Through a combination of physics-based learning (as per models such as a GCM or RCM) and statistical learning (based on distributions) it is feasible to fill gaps and map data based on similar characteristics that align with known or modelled results.

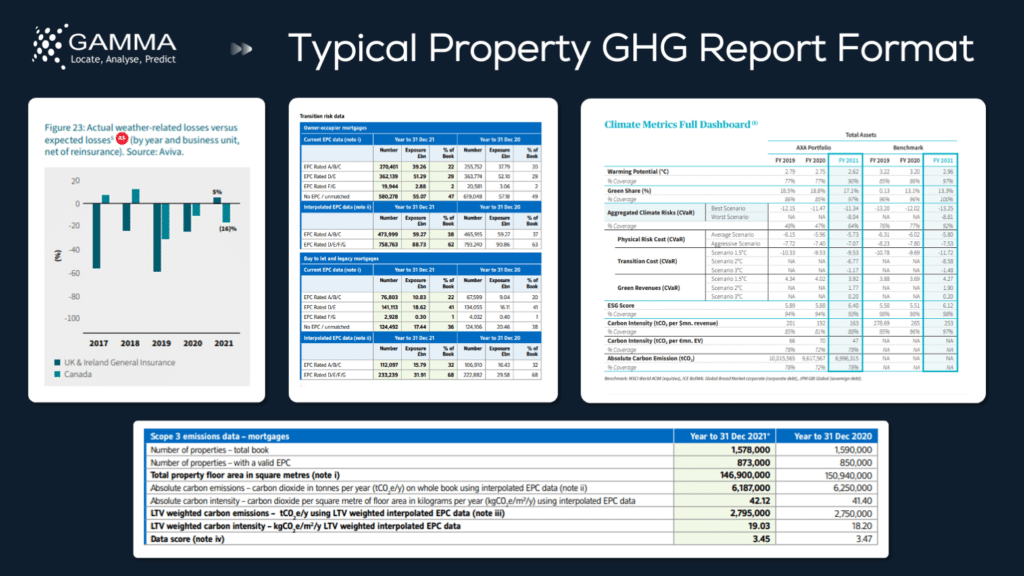

MEASURING CLIMATE RISK AND THE IMPACTS ON PROPERTY BOOKS

Taking a view on the longer term, Feargal O’Neill, CEO at Gamma, focused on how insurance and asset owners can start to address the long-term impact of climate change by understanding what projected impacts will do to existing books of business (or owned/managed property assets).

The drive in 2023 – and beyond – from regulatory reporting perspective will become more pronounced – Gamma can potentially assist.

How is the insurance sector measuring up..?

Climate change is increasing property risk and making those risks less predictable. Compounding that is the fact that property is increasing the risk of climate change through emissions – a circular, spiralling effect if left unchecked.

Consequently, any large organisation with a property portfolio needs to assess physical risks (those associated with the impact of climate change on that portfolio) and transitional risks (those associated with emissions and moving to a lower carbon economy).

Physical risks

For insurers, physical risk assessment is a relatively simple process to undertake. It requires some modification to existing models that are well understood and that have been utilised is assessing perils over many years.

When considering physical risks through the impact of climate change, we are generally seeing more frequent, more intense, yet less predictable events.

From an insurance perspective this insight needs to be factored into pricing. Whilst from an investment perspective there is a need to understand the potential for a loss in value of the investment over time due to climate impacts.

As such, forecast models need to take into account the potential scenarios that exist in terms of representative concentration pathways (RCPs) that project impacts based on differing increases in temperature warming across various time horizons or periods.

Whether a business takes a moderate or hard-line view on what the outcomes predict is currently at their behest – but assessing the impact needs to start.

Slide Image 5: Physical risk impact on property

Transitional risks

Traditionally these risks have not been measured – it is harder, it is newer, and will only become more complex as regulators stipulate the disclosures that organisations will need to make.

So how does that relate to property risk and impact..?

Essentially this is focused on high emission, inefficient properties, and the risk they represent to the insurer and/or the investor as society moves to a net-zero economy.

Many organisations have set expectations and made pledges to achieve net-zero – as such the overarching risk is one of reputation. Be that in terms of investors, employees, regulators, and customers – all of whom have the potential to take action if emissions are not being reduced.

Alongside this there is also the potential loss in asset value, as the property become less desirable and the financial consequences of holding poo performing properties in terms of emissions in your portfolio.

Slide Image 6: Transitional risk impact on property

So how do we report, track, and measure these changing risks..?

In terms of physical risk from an insurers perspective, there are currently 2 primary measures:

- Total value at risk (VaR), and

- Actual versus expected losses – the continuous appraisal of how well the model is performing.

For transitional risk, measurement is focused on emissions:

- Total GHG emission from the property portfolio – from absolution emission to emissions intensity.

Various institutions, partnerships, and action groups have collaborated to define standards in relation to these measurements with a focus on ensuring that it is easier for financial institutions to report consistently.

The TCFD (Taskforce for Climate-related Financial Disclosures) is perhaps the most well-known of these bodies – having produced what many other representative bodies reference as the standard in this area.

Perhaps the most practical interpretation and guidance comes from the PCAF (Partnership for Carbon Accounting Financials). Most recently they have partnered with the Net-Zero Insurance Alliance (NZIA) to produce an insurance related version to advise on standards, metrics, and methodologies for calculating carbon emissions and policies.

Estimating emissions

So how do you establish the estimated emissions for an individual property..?

From a residential (or domestic) property perspective, information exists for individual properties in terms of their BER or EPC rating – this is not comprehensive but can be utilised in a model to determine the rating of those that are similar in characteristics.

Then through a data enrichment process, portfolios can be tagged and reported upon to gain a comprehensive view and benchmark. Having determined this, organisations can adopt strategies to combat and improve their emissions position.

In terms of commercial properties, the modelling of BER or EPC rating is more challenging.

Large companies will disclose their emission. However, that is limited.

One approach is in relation to the activity that the organisation performs within any given property or location, but there is much debate on how to simplify this measurement.

The key takeaway is that capturing, measuring, and reporting will only become more onerous. Therefore, the learned advice is to make a start, be flexible and evolve.

Slide Image 7: Example climate disclosure reports for insurance & banking brands (Aviva, AXA, HSBC & Nationwide)

Challenges

The biggest challenge is around the lack of data – there are a number of assumptions, and models that need to be used in order to achieve a baseline measure from which organisations can start their journeys towards a net-zero economy.

There are potential issues around GDPR to accurately define what constitutes personal information versus building information.

BER/EPC data is based on average usage – as such there is the inherent challenge around the accuracy of the measures being applied.

Virtually no standardisation exists between countries – although there are movements under way to do that.

Physical risk models are new, albeit based on understood methodologies – but there is still advancement and enhancement that is required in this area.

Slide Image 8: Challenges, but support is just a conversation away

But ultimately this is a huge task – one that will become more comprehensive. Complex. Onerous.

Yet despite all of this, making a start will only hold you and your business in good stead as things evolve.

If BER/EPC data is used to establish emissions, what happens if the building hasn’t had a survey undertaken?

Given that there isn’t general access to individual records we have developed a model that predicts the rating based on the building typology/characteristics. The model has been benchmarked against actual BER/EPC ratings data to determine the level of accuracy and confidence in the ratings that are returned. Typically, we provide this as a dataset or as part of a data enrichment process, as well as utilising it to report aggregate ratings for a portfolio of properties within a clients’ book of business.

Could you use the bathroom model to flag properties with a “percentage chance” of a certain number of bathrooms?

Yes, of course. For example, you may want to assess those properties that have a more than 10% chance of having 5 bathrooms – and then review the properties on a case-by-case basis. Or set up a compound function that looks at 10% chance of 5 bathrooms and 20% chance of 4 or more bathrooms. But yes, appraising based on probability is certainly something that is feasible with the AddressLink data.

How is GDPR an issue with disclosures in climate-change?

There is a constant conflict – across territories/countries – where the interpretation of what constitutes personal data from a GDPR perspective. Providing data that combines or associates the address with “physical building attributes” can be interpreted as being one step too close to personal data and infringing upon privacy of the property owner. That conflict also aligns more broadly with enabling access to aid the use of data for the improvement or benefit of the environment versus an infringement on privacy – both of which are important – but finding the sweet spot is key.

@ 2022 Gamma.ie by Jason Day

About Gamma Location Intelligence

Gamma Location Intelligence is a cloud hosted spatial solutions provider that integrates software, data and services to help our clients reduce risk through location intelligence. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao, Spain, the company has expanded to become a global provider of innovative, cloud-hosted location intelligence solutions. Gamma Location Intelligence’s Perilfinder™ risk mapping platform provides property underwriters with access to trusted property-level risk data easily, quickly and accurately.