Mapping the Work-from-Home Spenders

Where is COVID-19 having the greatest impact on daytime demand for goods and services in Ireland? Where has the loss of daytime workers and students had the greatest impact on local business? Gamma, the location intelligence company, has used its data banks to analyse the patterns emerging in this area and released research on the findings.

How has Covid-19 redistributed demand in Ireland?

In the 18 months since the first COVID-19 lockdown, we have seen huge changes in the daily lives of Irish people. The switch to remote working and online learning means that lots more people are spending their days where they live, rather than commuting somewhere else for work or study.

Conversely, many areas previously busy with workers and students have become ghost towns. These changes have a significant impact on the distribution of demand for daytime goods and services such as those sold in coffee shops, grocers and DIY stores. The degree to which these changes may persist post-COVID is largely dependent on the nature of the occupations of residents in the areas.

Gamma has used mapped data and location intelligence technology to assess the winners and losers in this reallocation. Here are some of the key gainers and losers in this daytime market adjustment…

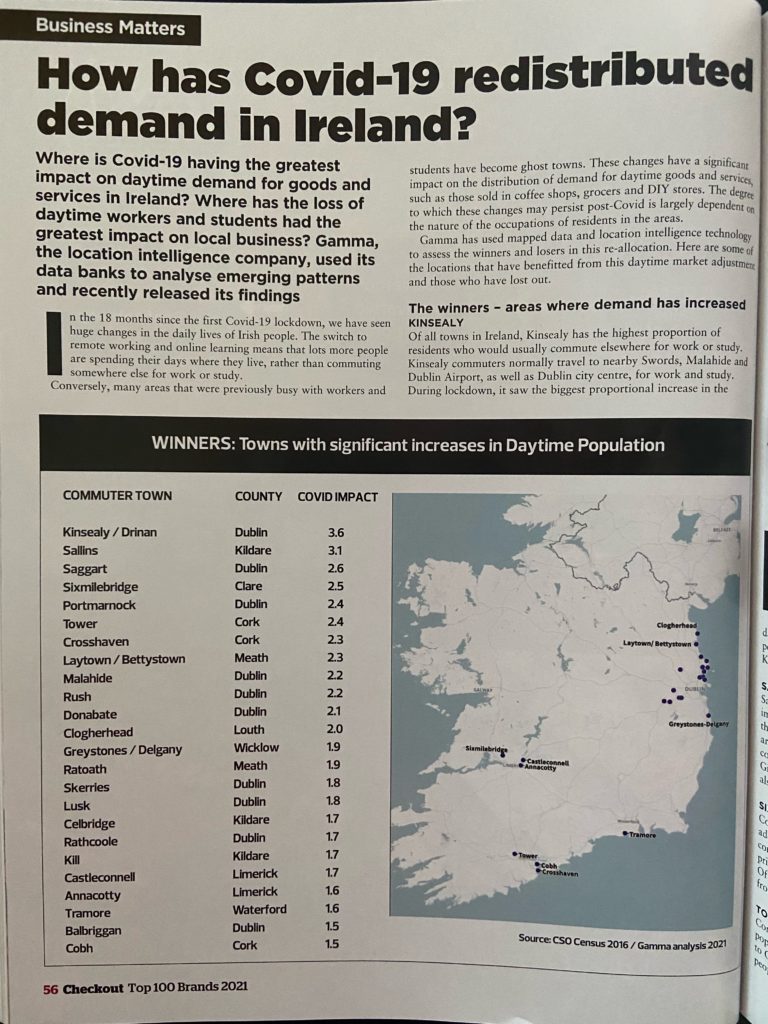

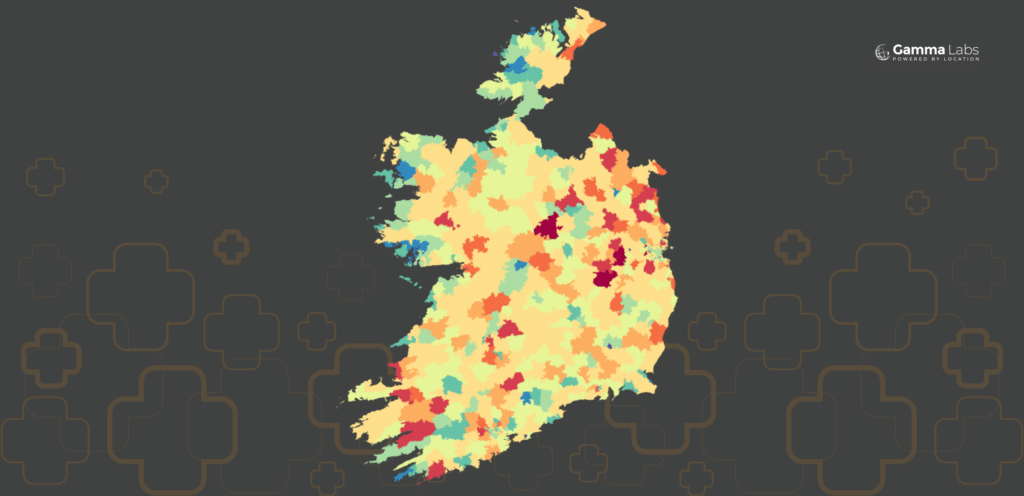

Map 1 – Towns with Increased Daytime Demand during COVID-19

The Winners – Selected areas where demand has increased

1. Kinsealy

Of all towns in Ireland, Kinsealy has the highest proportion of residents who would usually commute elsewhere for work or study. Kinsealy commuters normally travel to nearby Swords, Malahide and Dublin Airport, as well as Dublin City Centre for work and study. During lockdown, it has seen the biggest proportional increase in daytime population of any commuter town, with over 2,500 extra people around during the day. As there are 4,800 people living in Kinsealy, the significance of this increase is clear.

2. Sallins

Sallins is another fast-growing commuter town that has experienced a large impact in terms of workers now working from home. Dublin city is typically the most common destination for workers living there, enabled by the area’s good transport links. Almost 1,900 workers who usually commute elsewhere to work are now likely to be in Sallins during the day. Given that the population of Sallins is 4,100 people, this increase is also highly significant.

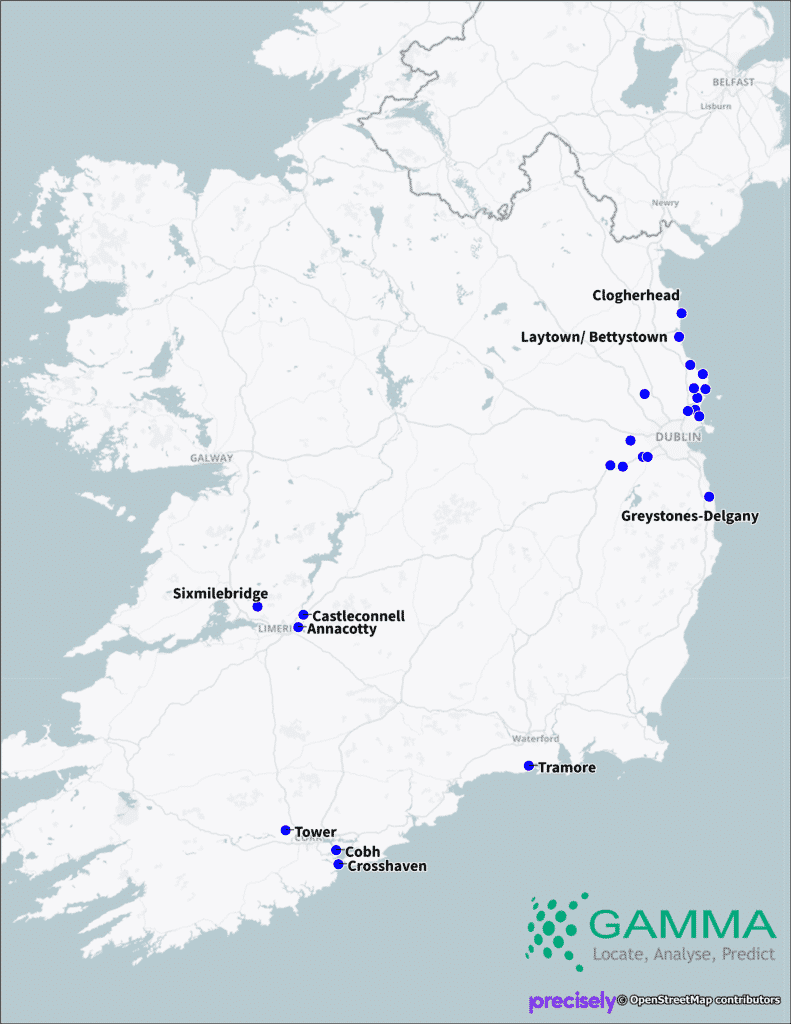

3. Sixmilebridge

Commuter towns around Dublin are not the only ones showing additional daytime population. Sixmilebridge in Clare is a smaller commuter town with over 1,800 residents. Workers living there travel primarily to Shannon, but also Ennis and Limerick City, for work. Of these, about 700 more than usual are expected to be working from home during lockdown.

4. Tower and Crosshaven

Cork City also has commuter towns showing large increases in daytime population. Workers in both Tower and Crosshaven primarily commute to Cork City Centre. Between the two towns, almost 1,500 additional people are at home during the day compared to pre-COVID times.

5. Celbridge

With almost 4,000 more people in the town during the day than normal, Celbridge is the commuter town with the largest number of additional daytime persons. The impact here isn’t quite as large as some other commuter towns due to the fact that it is a large town with over 15,000 residents.

Map 2 – Dublin Area – Towns with Increased Daytime Demand during COVID-19

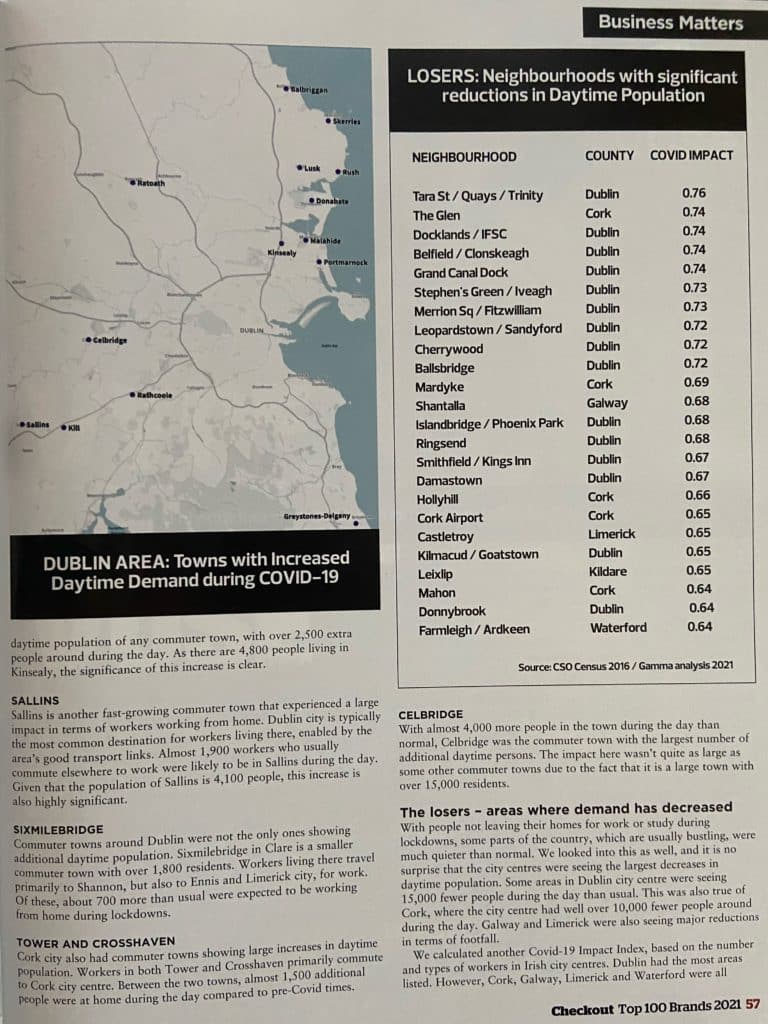

The Losers – Selected areas where demand has decreased

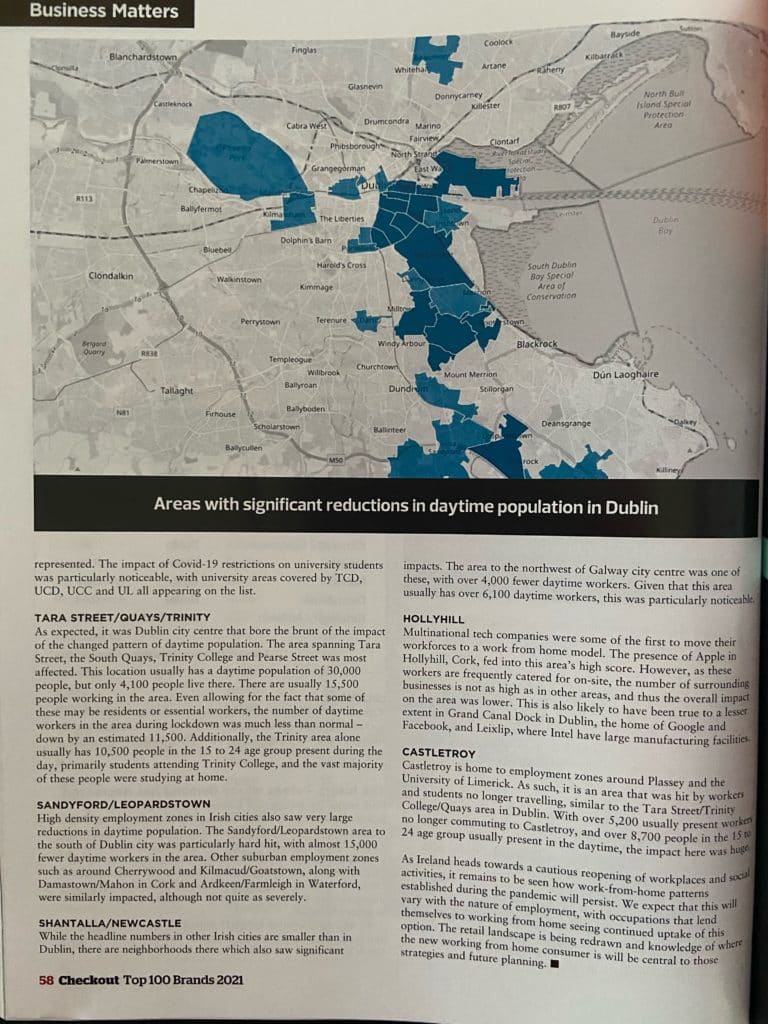

With people not currently leaving their homes for work or study, some parts of the country which are usually bustling are much quieter than normal. We looked into this as well, and it is no surprise that the city centres are seeing the largest decreases in daytime population. Some areas in Dublin City Centre are seeing 15,000 fewer people during the day than usual. This is also true of Cork, where the City Centre has well over 10,000 fewer people around during the day. Galway and Limerick are also seeing major reductions in terms of footfall.

We calculated another COVID-19 Impact Index, based on the number and types of workers in Irish city centres. Dublin has the most areas listed. However, Cork, Galway, Limerick and Waterford are all represented. The impact of COVID-19 restrictions on university students is particularly noticeable with university areas covered by TCD, UCD, UCC and UL all appearing on the list.

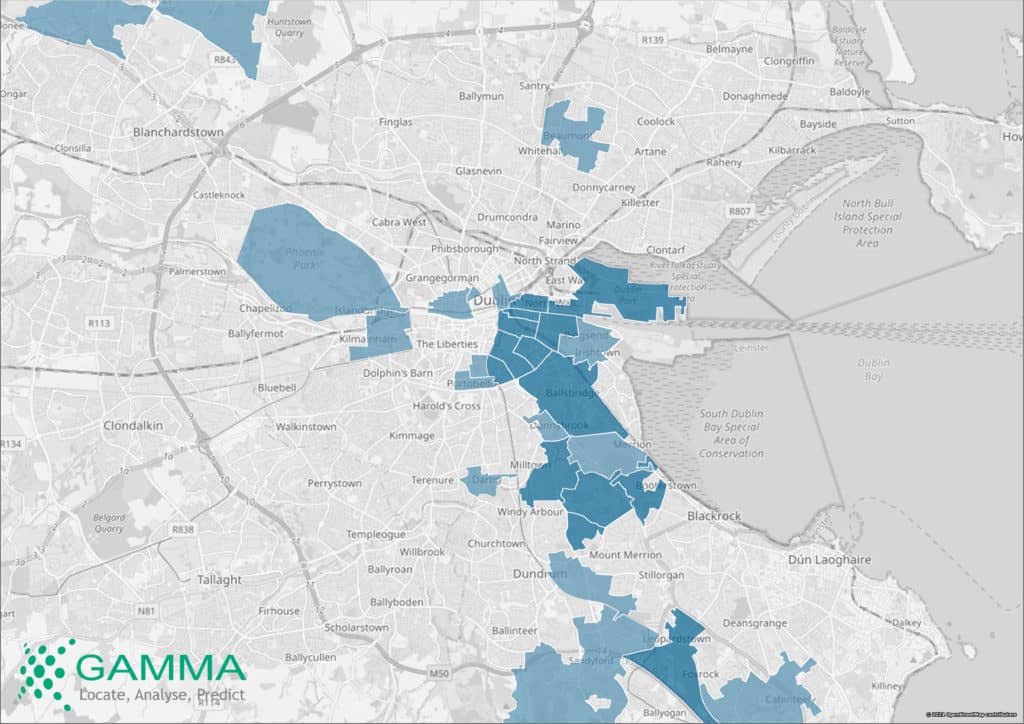

Map 3: Areas with significant reductions in daytime population in Dublin.

1. Tara St / Quays / Trinity

As expected, it is Dublin City Centre that bears the brunt of the impact of the changed pattern of daytime population. The area spanning Tara Street, the South Quays, Trinity College and Pearse St is most affected. This location usually has a daytime population of 30,000 people, but only 4,100 people live there. There are usually 15,500 people working in the area. Even allowing that some of these may be residents or essential workers, the number of daytime workers in the area during lockdown is much less than normal – down by an estimated 11,500. Additionally, the Trinity area alone usually has 10,500 people in the 15-24 age group present during the day, primarily students attending Trinity College, and the vast majority of these people are now studying at home.

2. Sandyford/Leopardstown

High density employment zones in Irish cities are also seeing very large reductions in daytime population. The Sandyford/Leopardstown area to the south of Dublin city is particularly hard hit, with almost 15,000 fewer daytime workers in the area. Other suburban employment zones such as around Cherrywood and Kimacud/Goatstown, along with Damastown/Mahon in Cork and Ardkeen/Farmleigh in Waterford are similarly impacted, although not quite as severely.

3. Shantalla/Newcastle

While the headline numbers in other Irish cities are smaller than in Dublin, there are neighborhoods there which are also seeing significant impacts. The area to the northwest of Galway City Centre is one of these, with over 4,000 fewer daytime workers. Given that this area usually has over 6,100 daytime workers, this is particularly noticeable.

4. Hollyhill

Some areas in Irish towns and cities are dominated by large employers. Multinational tech companies were some of the first to move their workforces to a work from home model. The presence of Apple in Hollyhill, Cork, is feeding into this area’s high score. However, as these workers are frequently catered for on-site, the number of surrounding businesses is not as high as in other areas and thus the overall impact on the area is lower. This is also likely to be true to a lesser extent in Grand Canal Dock in Dublin, home of Google and Facebook, and Leixlip where Intel have large manufacturing facilities.

5. Castletroy

Castletroy is home to both employment zones around Plassey and the University of Limerick. As such, it is an area that has been hit by both workers and students no longer travelling, similar to the Tara Street/Trinity/Quays area in Dublin. With over 5,200 usually present workers no longer commuting to Castelroy, and over 8,700 people in the 15-24 age group usually present in the daytime, the impact here is huge.

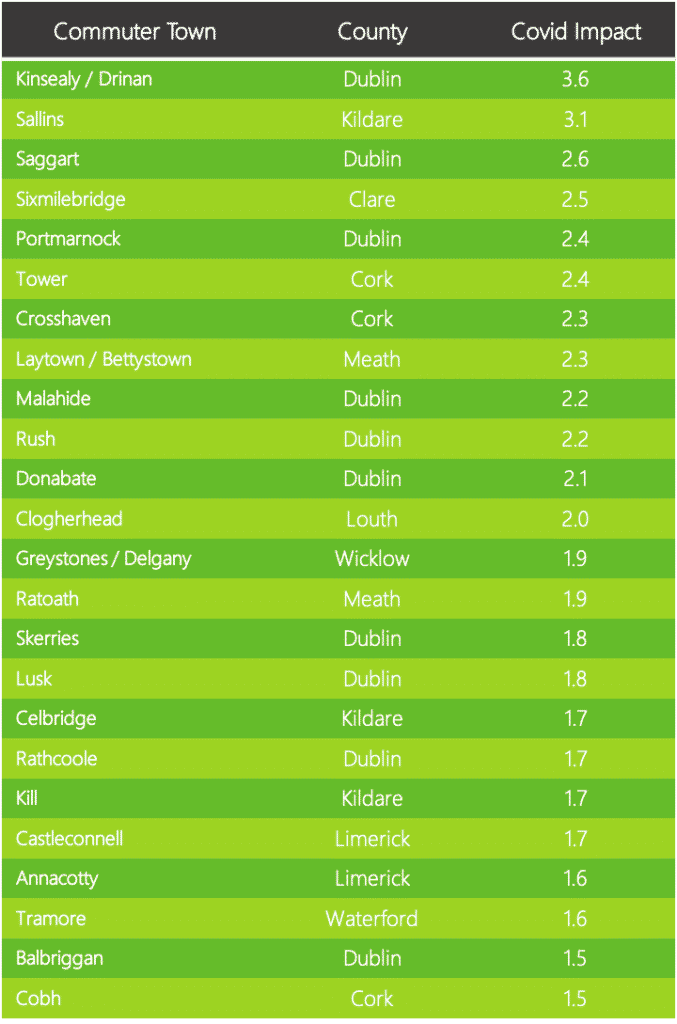

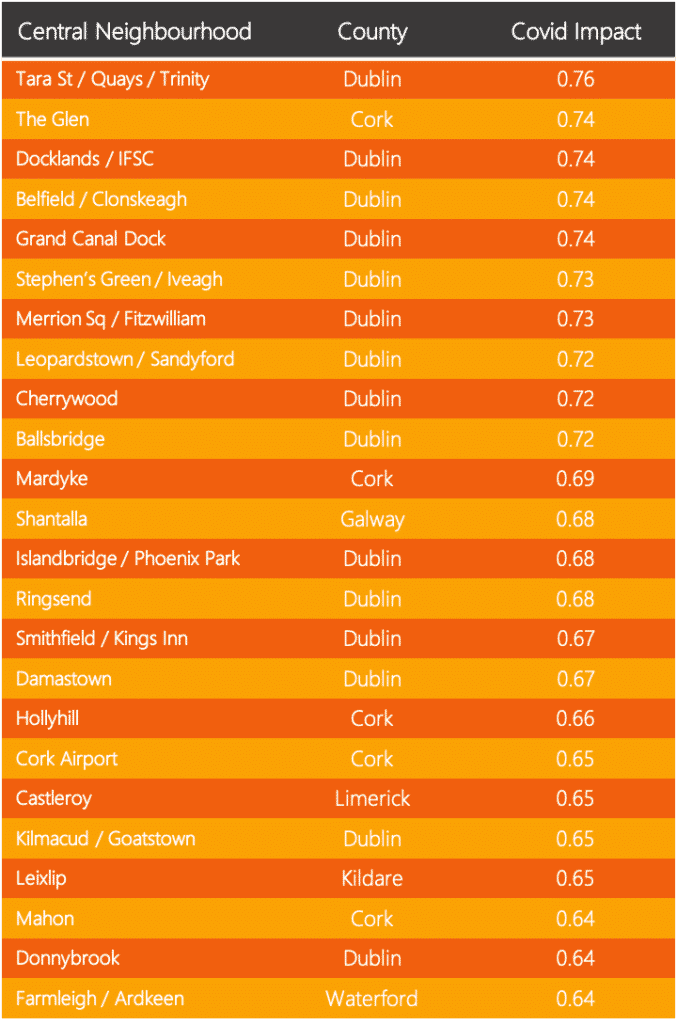

Here are the top winners and losers in terms of daytime demand as analysed using Gamma’s COVID-19 Impact Demand Index. (Placed in two separate tables.)

Table 1 – The Winners – Towns with significant increases in Daytime Population

Source: CSO Census 2016 / Gamma analysis 2021

Table 2 – The Losers – Neighbourhoods with significant reductions in Daytime Population

Source: CSO Census 2016 / Gamma analysis 2021

As Ireland heads towards a cautious reopening of workplaces and social activities, it remains to be seen how work-from-home patterns established during the pandemic will persist. We expect that this will vary with the nature of employment, with occupations that lend themselves to working from home seeing continued uptake of this option. The retail landscape is being redrawn and knowledge of where the new WFH consumer is will be central to those strategies and future planning.

A snapshot of Gamma’s research findings was published in the Sunday Business Post (June 27th). The full results first appeared in the Checkout Top 100 Brands 2021 magazine (September 10th).

Above: A snapshot of Gamma’s research findings in the Sunday Business Post (June 27th).

Below: The full results first appeared in the Checkout Top 100 Brands 2021 magazine (September 10th).

@ 2021 Gamma.ie by Richard Cantwell

About the Author

Richard Cantwell, Principal Consultant, Gamma, has over 25 years experience of managing and delivering Location Intelligence projects in Ireland, the UK and Internationally. Richard is particularly interested in using spatial data, models and analytics when working closely with clients in the retail sector to gain insight, support decisions and improve outcomes.

About Gamma

Gamma Location Intelligence is a cloud-hosted spatial solutions provider that integrates software, data and services to help our clients reduce risk through Location Intelligence (LI). Gamma LI’s Storecast Sentry™ platform assists retailers in optimising their store networks for the future. Gamma LI is headquartered in Dublin, Ireland and has offices in Manchester, UK and Bilbao, Spain.

Storecast Sentry, is a retail network optimisation platform that leverages data-driven location intelligence, spatial models & anonymised transaction data. The highly visual maps & dashboards, empowers multi-branch retailers to optimise their retail estate in our rapidly changing omnichannel landscape.