How will retail chains change after Covid?

Just when we thought things were improving …

In terms of the economic impact of Covid-19, few would argue that the retail and hospitality sectors haven’t suffered most. And as with the pandemic itself, the retail categories with existing underlying issues are experiencing the severest impacts. Those with efficient store networks and established digital channels fared best. And the omnichannel balance will be just as crucial going forward.

Prior to Covid-19, bricks and mortar retailers were already facing serious challenges due to the increasing popularity of online shopping. The traditional retail model was being disrupted and reimagined long before the arrival of the pandemic with proposals around making stores more experiential, having quicker check-outs and enabling personalisation in-store frequently discussed in the many articles on this topic. Unfortunately for many, the pandemic hit before this evolution could really take hold.

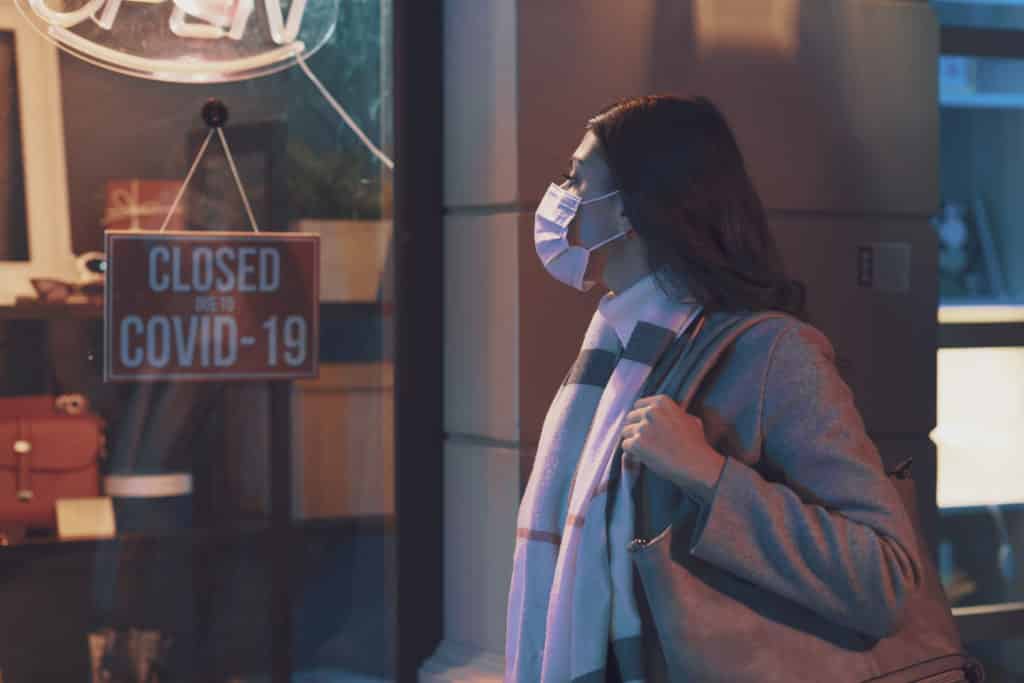

Covid-19 has accelerated the transformation of retail. It has targeted those already struggling, those with poorly planned networks and those that didn’t have a ready-made online alternative. Primark, for example, predicts a £1 billion hit in sales due to lockdown, as its lack of an online channel proved challenging. In the pandemic, not all categories have been hit equally. Grocery, pharmacies and local stores, for example, have fared well in many cases, as travel has been curtailed and the focus has changed to local shopping and stay-at-home dining.

The list of chains permanently closing, going into administration, restructuring their model or cutting store numbers is growing daily and includes household brands such as Debenhams, Topshop, Argos, Dorothy Perkins, Jaeger, Monsoon, Miss Selfridge, Bon Marche and TM Lewin.

The challenge now for physical stores

As the debate continues on whether retailing will ever return to the way it was before the pandemic, many believe that consumer shopping behaviour has been permanently altered. The greatest exposure is to those operating multiple stores in badly impacted categories. For these larger retail networks, the stark choices they now face post-lockdown are:

a) Keep going as before – some will do this due to a lack of options or inertia.

b) Rationalise the physical network, cut costs and operate at a smaller scale.

c) Move everything online and close all physical stores. (TM Lewin has gone this route in the UK, for example).

d) Expand branches. Some retailers will see the retail exodus as an advantage to expand their networks at a favourable cost.

e) Close completely.

f) Create a new optimised omnichannel network strategy that takes the best from physical store experience and online convenience.

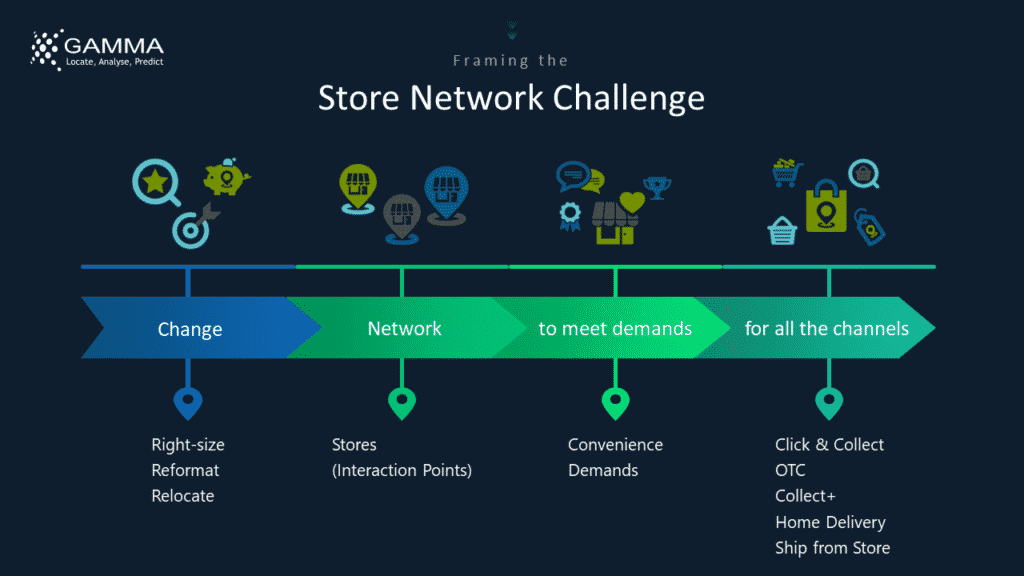

The businesses that choose to reassess their omnichannel strategy can optimise physical and online stores. Furthermore, they can position themselves as the most convenient choice for their target market, while also restoring sustainable margins through each channel and reducing investment risk. After all, the pandemic doesn’t present a channel-specific challenge, but rather poses a multi-layered and integrated puzzle that will be solved by identifying the most competitive, customer-centric combination of stores, delivery services and click and collect options.

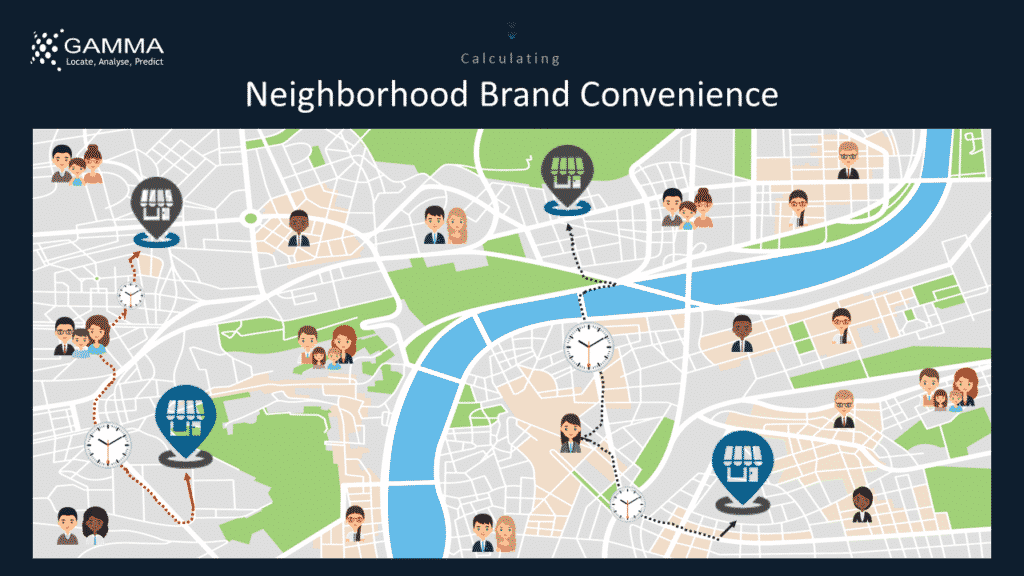

However, while closing several stores in an area may boost the footfall to another, closing too many could terminally affect the store’s brand strength. Research shows, somewhat counter-intuitively, that online sales tend to be highest closest to physical store locations. Clearly, showrooming matters.

The online sales uplift generated by having a store in the area must therefore be factored in before evaluating the net cost of a store closure.

So, how can a retailer optimise its estate to offer a cost-effective presence that will satisfy consumer demands for convenience into the next decade? Firstly, it needs to understand its market, map it out and see how customers are engaging through each channel. The retailer needs to see where its customers are at what times, and overlay this information with its stores.

Consumers may have changed their behaviour due to Covid and this also needs to be considered – for instance, a proliferation of people working from home permanently or part-time may make suburban locations score higher.

Using these data-driven insights – which we deliver to our retail customers through our Storecast™ platform – retailers can build an optimum network that satisfies their convenience goals. To fully optimise, the strategy must measure and enhance omnichannel convenience for the retailer’s target market, while still satisfying other site and market constraints such as lease obligations.

A balanced future

Post-lockdown, retail will emerge and make the changes necessary to thrive. The businesses choosing to change will make their networks more efficient and relevant to the modern consumer through the following actions:

1. Fully evaluating their physical store estates and devising an omnichannel strategy that acknowledges the new retail landscape and post-Covid world.

2. Continuing along the pre-Covid path to make stores more experiential, convenient and integrated alongside their digital channels.

3. Expanding their online channels at a faster rate as a consequence of changing consumer behaviour.

4. Rethinking store design and space utilisation due to both increasing showrooming functions and social distancing requirements.

5. Merging, partnering with and inviting concessions to optimise return on retail space and offset the reduced network requirement.

To adjust to the post-Covid landscape, retailers must reassess their store estate and design a futureproof omnichannel network that combines all channels with the customer at the centre. Store location planning now involves designing store and online networks that can evolve quickly and better reflect the ever-changing nature of the retail world. This makes the process considerably more complicated and now requires an even broader and more flexible view on the meaning of retail presence.

Retail will thrive again – and physical stores remain an important part of that future. Their numbers, fascias, nature and purpose will however change considerably in the coming years. The new watchword will be omnichannel.

@ 2021 Gamma.ie by Feargal O’Neill

This article first appeared in ThinkBusiness.ie.

About the Author

Feargal O’Neill, chief executive officer, Gamma, has over 25 years’ experience in formulating and applying location intelligence strategies in the retail sector. As a location analytics and spatial modelling expert, Feargal helps retailers realise greater benefits from location-based information. Gamma’s Storecast platform assists retailers in optimising their store networks for the future. Gamma is a Location Intelligence (LI) solutions provider that integrates software, data and services to help its clients reduce risk through location intelligence. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao, Spain, the company focuses heavily on cutting-edge research and development projects, leveraging Artificial Intelligence and machine learning.