Webinar Overview: GeoInsurance Ireland – Part 2

Last year, Gamma hosted its first GeoInsurance Ireland event in Dublin, but this year – for obvious reasons – we couldn’t meet in person. So we went virtual, hosting the GeoInsurance Webinar Series 2020.

GeoInsurance Ireland, Part 1 – New Models for New Times – focused on how modelling techniques can be used to build valuable datasets. GeoInsurance Ireland, Part 2 – An Evolution of Risk Data – discussed new data developments and how Location Intelligence (LI) is driving parametric insurance. While the third part – GeoInsurance & Climate Change – concentrated on climate change forecasting in the general insurance and reinsurance sectors.

If you didn’t get the opportunity to check out the second GeoInsurance Ireland webinar, here’s a short overview. You can also watch it on-demand.

GeoInsurance Ireland, Part 2: An Evolution of Risk Data

There has been a lot of discussion recently on making the ecommerce experience as seamless as possible for the customer. With this in mind, Gamma’s recent GeoInsurance Ireland, Part 2 webinar on the evolution of risk data explored what information is available that can improve customer onboarding while still preserving data quality.

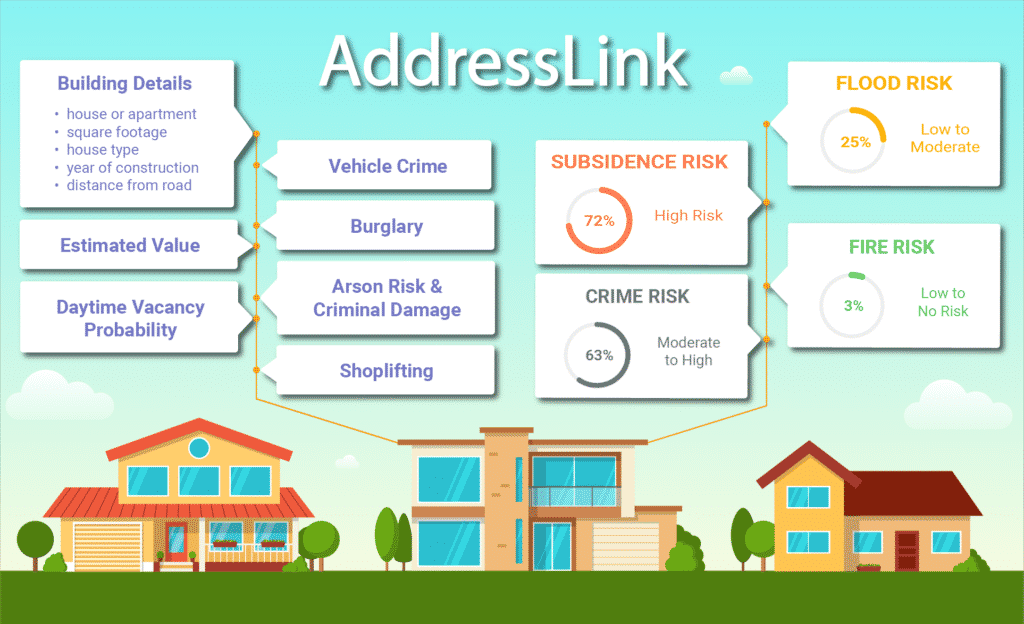

In this webinar, we presented an overview of our latest development, AddressLink, which will become the central data depository for building-level data for Ireland. Industry speakers have also discussed the use of geospatial data in parametric insurance and motor fraud modelling.

AddressLink: Building-level Data for UK & Ireland

Our first speaker was Richard Cantwell, Senior GIS Consultant with Gamma, who provided an overview of AddressLink, Gamma’s proprietary building-level data repository for the UK & Ireland. AddressLink provides independently verified and reliable building-level data, synthesising data from Gamma’s in-house sources, their partner network, and also open data.

In the insurance sector, connected to Prefill web services, Addresslink offers a faster way for your customers to provide details online to your property questions, reducing cart abandonment and making the quotation process as trouble-free and intelligent as it can be. It eliminates data input errors, prevents omissions while reducing time spent on data entry.

How is Location Intelligence Driving Parametric Insurance?

Our next presenter was Feargal O’Neill, Gamma’s CEO, who, like Richard Cantwell, has over 25 years’ experience with spatial data, consulting and building solutions for many of Ireland’s biggest organisations. Feargal spoke about parametric insurance. As climate change impacts make weather-related events more frequent and severe, he believes insurers may need to consider the scope of the traditional insurance indemnification model and perhaps consider alternative or complementary approaches such as parametrics.

LI technology is at the core of most parametric applications, where environmental perils are the trigger points. Parametric insurance, enabled by rapid developments in LI and driven by changes in environmental risk levels, will undoubtedly become more and more relevant in the coming years and decades. It allows policyholders to cover consequential losses in a much less complicated model.

Feargal spoke about the possible applications of parametric insurance in Ireland, as well as its benefits. Most insurers want to reduce the complexity of taking out cover. They also aim for quicker, less complicated pay-outs and better visibility of exposure to loss events. The main advantage to the insurer is the speed of payout, because it is predefined. The second big advantage is that it is predictable. Thirdly, it provides flexibility, providing cover in areas where traditionally it might not have been possible.

You can access a blog on parametric insurance that Feargal published earlier this year.

Data Usage in Motor Fraud Modelling

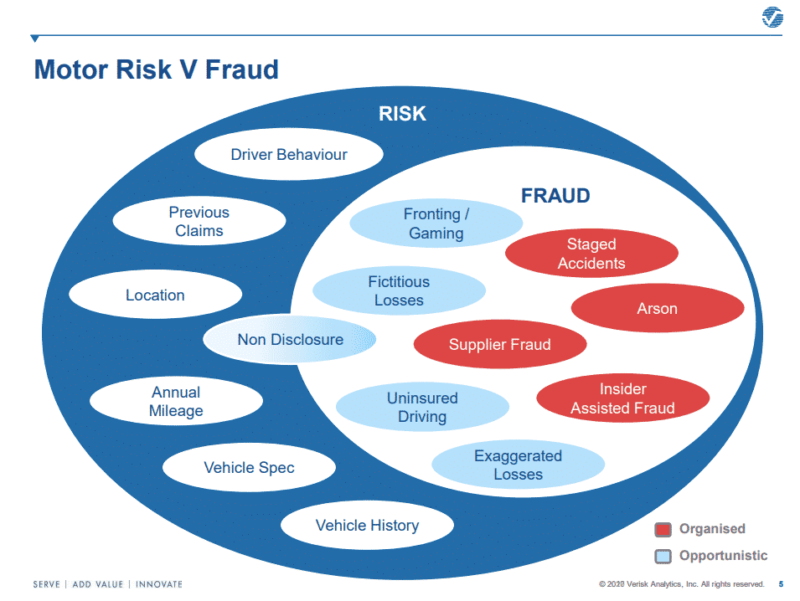

Next up was Niall Kavanagh, Managing Director of Verisk Ireland. Niall has lots of experience delivering solutions to the insurance sector, having previously worked for Risk Intelligence Ireland before they were taken over by Verisk in 2016. Niall introduced us to the uses of data in detecting fraud in the motor insurance sector.

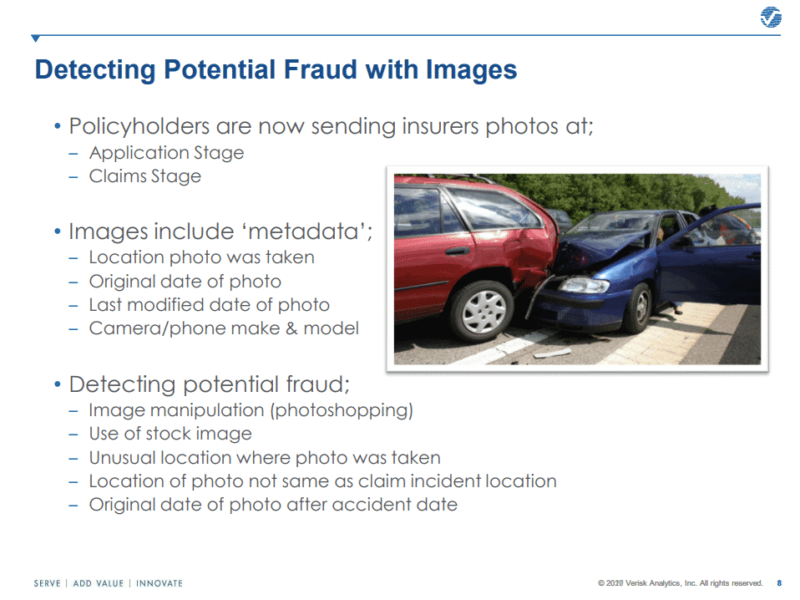

Niall gave a few examples where motor fraud was identified through disparate data sources, from vehicle information, car selling websites, location and image information. He explained how Verisk’s fraud detection product, which provides a comprehensive suite of solutions, from real-time fraud analysis to intel processing to image forensics, can help insurers detect fraud at every stage of the claim and manage cases more effectively.

The speakers were then joined by Robert Moss, Senior Data & GIS Analyst with Zurich, for the Q&A session. Robert provided an industry perspective, speaking about the valuable datasets he would like to see available in the Irish insurance sector. In his view, the accessibility of data is as important as its availability.

You can watch this webinar on-demand.

@ 2020 Gamma.ie by Monika Ghita

About Gamma

Gamma is a Location Intelligence (LI) solutions provider; we integrate software, data and services to help our clients reduce risk through better decision-making. Established in Dublin, Ireland in 1993, and with offices in Manchester, UK and Bilbao Spain, the company has expanded to become a global provider of information systems, micro-marketing solutions and geographical analysis services. Gamma Location Intelligence’s Perilfinder™ risk mapping platform is the number one underwriting solution used by Irish insurers to assess environmental risk.